Resources

Resources

Three New Ways to Bank Better with the CPB Mobile APP

At Central Pacific Bank, we are always looking for ways to make your banking experience easier and more convenient. Our latest mobile app updates add three powerful features to help you stay on top of your finances and manage your money with ease.

Check Your Credit Score Anytime

Your credit health matters, and now you can keep tabs on it right from your CPB Mobile App. With a few easy steps, you can enroll and gain access to:

- Your current credit score

- Your full credit report

- Educational tools to help you build and maintain strong credit

- Personalized credit offers tailored to you

Find this feature on the homepage widget under “View Credit Score” or by navigating to Menu > Credit Score.

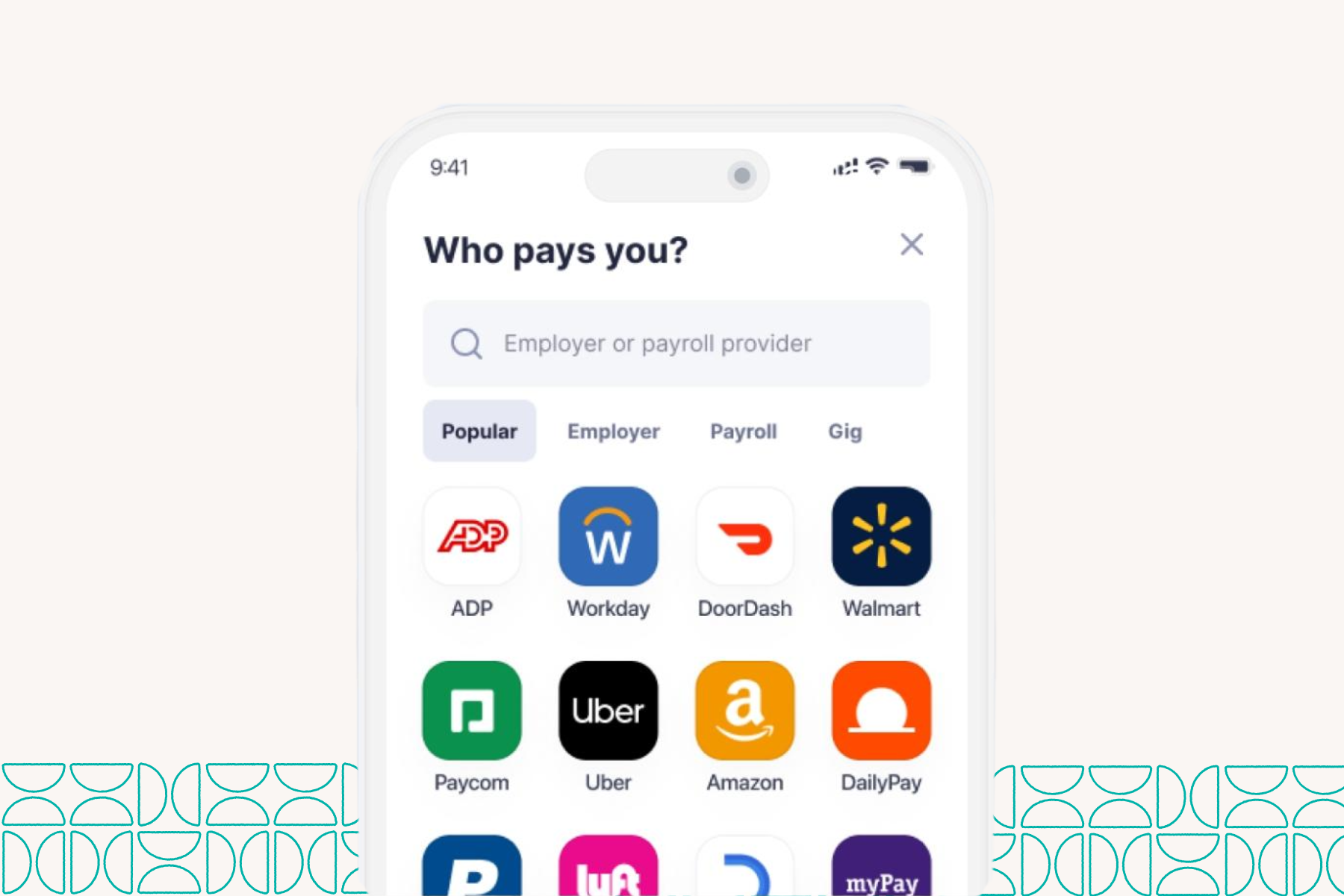

Switch Direct Deposit in a Snap

With this update, you can now set up or switch your direct deposit directly in the CPB Mobile App. It is the same secure and convenient process you may have used in Online Banking, now made mobile.

Open New Accounts Right from the App

You can now open select checking and savings accounts directly from your mobile app:

- CPB Checking Accounts: Shaka Checking, Value Checking, Exceptional Checking

- CPB Savings Accounts: Personal Savings, Personal Super Savings

How It Works

- Log in to the CPB Mobile App.

- Tap Menu > Open New Account.

- Select your account, review disclosures, and submit your application.

- Once complete, you will get a confirmation email right away.

Funding Your New Account

- Fund Now: After opening, log out and back into the app to transfer money from your existing CPB account.

- Fund Later: You will have 30 days to make your first deposit through mobile or ATM deposit, in-branch, mailed check, or transfer. If the account is not funded within 30 days, it will automatically close.

One-Time eSign Update

As part of this update, you will be prompted to consent to a new Electronic Delivery and Signing of Documents (eSign) agreement when logging into Online or Mobile Banking. Reviewing and accepting the updated agreement is quick and easy, and it helps us bring you even more convenient digital banking services.

Why You’ll Love It

- Stay on top of your credit score and credit report

- Easily switch or set up direct deposit

- Open new accounts anytime, anywhere

- Manage all your CPB accounts in one secure place

And remember, if you ever need a hand, our friendly staff at all CPB branch locations are always ready to help. However you choose to bank, We Got You.

Offering expert insights on a variety of topics such as home affordability, small business growth, international economic trends, and digital banking.

Share

Share