Simplify your Business Online Banking

Simplify your Business Online Banking

Digital Banking Conversion

For Business Online Banking Users –What You Need to Know:

Login Instructions Effective 3/15

To access the newly upgraded digital banking platform, log in using your existing username and follow the simple steps to choose a new password.

NEW MOBILE APP EFFECTIVE 2/22

You will need to download our new mobile banking app to access your accounts.

Important reminder: In the new platform, your current business online banking username and newly created password will provide you digital banking access through the browser AND the app. You no longer need to have a separate username and password.

Make sure you delete the current mobile app from your phone.

Go to your device’s app store and download the new app by searching “CENTRAL PACIFIC BANK.” Look for the wave app icon.

Or click on the links below:

Quicken® and QuickBooks® Users – Reactivation Instructions

See PDF links below for step-by-step instructions to deactivate and reactivate your account based on the platform you are currently using.

When linking your account, you will need to select: Central Pacific Bank – HI. If you receive a message about needing to download transactions from your old feed, read this QuickBooks Help article for instructions.

Quicken

- Quicken for Mac Conversion Instructions (Web Connect)

- Quicken for Mac Conversion Instructions (Express Web Connect)

- Quicken for Windows Conversion Instructions (Express Web Connect)

- Quicken for Windows Conversion Instructions (Web Connect)

Quickbooks

Quicken for Mac Conversion

Quicken for Windows Conversion

Quickbooks Connecting Your Accounts

QuickBooks for Mac Conversion

QuickBooks for Windows Conversion

Quickbooks for Online Conversion

Business Online Banking FAQ

Conversion

If you’re already enrolled in Business Online Banking, there is no need to re-enroll.

Yes. On launch day or thereafter, if you use the Business Online Banking mobile app, you’ll need to delete the current app from your device and download the new version from the Apple App Store or Google Play store.

No. In the new platform, your current online banking login ID and password to access your account from a web browser AND the mobile app.

- You should not need to reset your current login and password, but if you have trouble, you may use the Forgot Password feature from the login page.

- If you previously set up a password specifically for mobile banking login, you will no longer use that password to login through the mobile app. Instead you will use the same password that you created for online banking (browser) login.

When logging in to Business Online Banking for the first time, either through online banking (browser) or the mobile banking app, you’ll be prompted to set up new security questions and answers.

CPB customers asked us to simplify the digital banking login process and we listened to that feedback. The new digital banking products share a single username and password, which can be used to login from any device.

Enrollment

Select Enroll as a Business User from the app login screen or cpb.bank/online-services-enrollment

- Review and accept the Registration Disclosure

- Fill out the Business Enrollment Form online and Print.

- Have all authorized signers on the account sign the form and mail it back to:

Central Pacific Bank

Attn: Electronic Banking Department

P.O. Box 3590

Honolulu, HI 96811

Once we have received your signed Enrollment Form, we will send you an email with instructions on how to login.

The enrollment process for our foreign business customers is the same as it is for our domestic business customers.

LogIn

Go to cpb.bank or open the app on your mobile device.

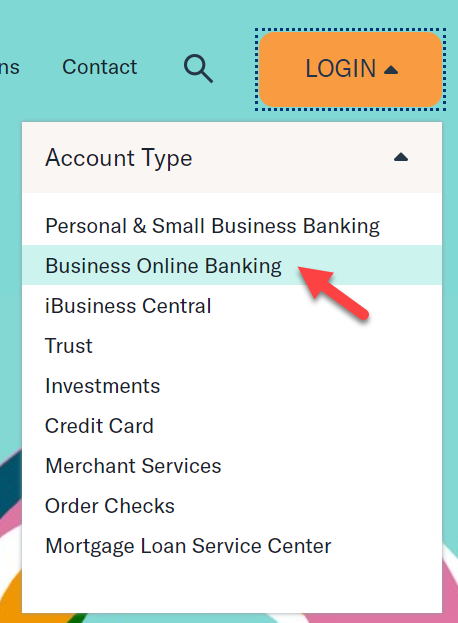

- If you’re accessing digital banking through the browser, click login at the top right of the page and make sure the Account Type is set to Business Online Banking.

Input your login ID and password.

- This login and password will be used whether you’re accessing your account from your browser or the mobile app.

If you forgot your password, you can reset it by clicking the Forgot Password link next to the login button.

If you need help, contact our Customer Service Center at 808-544-0500 or toll-free at 1-800-342-8422.

To reset your password:

- From either cpb.bank or the mobile app, click Forgot Password (located below or next to the Login button).

- On this screen, input your username and an email address or date of birth (mm/dd/yyyy), enter your info and click submit.

- You will be prompted to verify your identity with our out-of-band authentication process. Typically, this is a text message or phone call.

- After authenticating, you will need to input your new password and click Set Password to submit. Passwords must be 8 to 26 characters long and must contain the following: One Letter (upper or lower case), One Number (0-9), and a Special Character (~!@#$%^&*()_+-={}|:;?,./).

To reset your username:

- Login at either cpb.bank or the mobile app. Go to the Profile tab, then select Username.

- Create a unique username that is 8 to 2632 characters long.

If you forgot your username, contact our Customer Service Center call 808-544-0500 or toll-free at 1-800-342-8422.

CPB has introduced a more secure means for resetting passwords. Rather than receiving an email to reset your password, you will be prompted with an out-of-band authentication request to verify your identity before resetting your password. After changing your password, you can expect an email notification that your password has been changed.

If you do not receive this email, and your email on file is correct, contact our Customer Service Center at 808-544-0500 or toll-free at 1-800-342-8422.

After five (5) failed attempts, your account will be locked. To unlock your account, contact our Customer Service Center at 808-544-0500 or toll-free at 1-800-342-8422.

Yes, our applications share a single set of login information.

CPB customers asked us to simplify the digital banking login process and we listened to that feedback. The new digital banking products share a single username and password, which can be used to login from any device.

Out of Band Authentication (OOBA) is a multi-factor authentication process that provides your account with an additional layer of security.

If an unauthorized user gained access to your login credentials, the fraudster would be unable to complete a transaction without having access to your mobile phone or landline.

We do not offer email as an Out of Band Authentication (OOBA) option.

We require the OOBA verification code to be sent by text or call to the phone number that you designate. You have the option of storing up to 3 different phone numbers in your digital banking profile.

If you need to update the phone numbers connected to your profile, contact our Customer Service Center at 544-0500 or Toll Free at 1-800-342-8422.

Security Questions

A security question is a “shared secret” between you and the digital platform, and it’s used as an identity authenticator.

When setting up your CPB digital banking profile, you’ll be asked to answer security questions so that you can easily recover your account if you forget your password.

In order to maintain the security of your account information, we’ve increased the security of our login process. Our security system will request that you verify your identity by answering an out-of-band authentication request or by answering a security question.

You can update your security questions by navigating to the Security Questions page from the Profile menu. However, to maintain the security of your account information, only our Customer Service Center can reset your security questions if you’re having trouble remembering your answers.

We agree; some of the questions are strange but there is good reason. The questions, which were provided by our security vendor, are intentionally unusual to safeguard your account from fraud.

For other programs, you’ve probably seen questions such as, what was your high school mascot or the name of your first pet. While those types of questions may seem obscure to you, they might not be for a hacker. Quick internet-based research and some educated guests might be all a hacker needs to answer your security questions, reset your password and gain access to your account.

Here’s a tip for security questions that might be too easy for the bad guys to guess: try adding a twist to your answer like writing it backwards, adding a date or adding a symbol.

BillPay & Zelle®

To enroll in Bill Pay select Pay Bills from the navigation and review and agree to the Terms & Conditions.

- Add a Company or Person from the mobile app:

- Click Add a New Biller

- From the dropdown menu, select whether you want to add a company or person, input the information of the biller and click add.

- Add a Company or Person from the browser:

- Click Add a Company or Person

- To add company: use the search bar to look up the company or input the company information directly. You can also look for the business you’d like to add by choosing a category button.

- To add a person, toggle to Person using the tab menu and enter the person’s information.

Whenever possible, our Bill Pay system will send your payment electronically. However, if the payee cannot accept an electronic payment we print a check and mail it to the address you provide.

To enroll in Zelle, select Send Money with Zelle from the navigation and review and agree to the Terms & Conditions.

Click the Enroll button and complete the enrollment process.

You can view your limits within the Zelle page.

Payments are received quickly, typically within minutes, when:

- You send money to a recipient’s email address or mobile number that is registered with Zelle.

- You send money to a bank account that is eligible to receive payments in minutes.

Payments sent to an email address or mobile number that isn’t registered with Zelle may take 1-3 business days after the recipient registers, or be received on the delivery date, whichever is later.

To add a contact using the mobile app:

- Go to the Send Money with Zelle page.

- Click Settings listed with the gear icon on the right side of the screen.

- Click the Contacts button.

- Click the Add a New Contact button.

- Input your new contact’s First Name, Last Name, and either their email, phone number, or bank account info.

- Click Save to add the contact.

To add a contact when accessing from a browser:

- Go to the Send Money with Zelle page.

- Click the Add a New Contact button.

- Input your new contact’s First Name, Last Name, and either their email, phone number, or bank account info.

- Click Save to add the contact.

Although you do not have the option to add animated stickers, you can add emojis to the note that can be sent with your payment.

Yes your Pop Money contacts will convert to Zelle. However, we suggest you review your contacts to ensure everything is as it should be.

Yes, recurring payments set up on the current PopMoney function will convert to Zelle. However, we suggest you review your recurring payments to ensure everything is as it should be.

No. There’s no cost to use Zelle in our new Digital Banking experience.

Zelle® has replaced Popmoney. Both are services that can be used to send money to people you know and trust but there is one distinguishing feature: speed.

Zelle payments are received quickly, typically within minutes, when:

- You send money to a recipient’s email address or mobile number that is registered with Zelle

- You send money to a bank account that is eligible to receive payments in minutes.

Transfers

The digital banking app is intuitive and will guide you through the steps while you’re using the function. For step-by-step instructions to setup an internal transfer:

- Login to the CPB digital banking app

- Locate the Transfer link, then click to reveal the Transfers menu at the bottom of your screen.

- To set up a Transfer:

- Select a From and To account by clicking Choose Account and selecting one of the listed accounts.

- The From account will be the account the funds will be withdrawn from.

- The To account will be the account the funds are transferred to.

- Click Enter Amount and enter the dollar amount you’d like to transfer.

- Click Done.

- The Send On date defaults to send Today.

- To change the date, click Today and select the date you’d like to send, then click Apply

- The Frequency will default to make a One Time Transfer.

- To change the Frequency and create a Recurring Transfer, click One Time and select the Frequency you’d like the transfer to occur. Then select Done.

- When setting up a recurring transfer, once you’ve selected a frequency that is not One Time, a new option to select Duration will appear. This option will default to Until I Cancel. You can also set the duration to a specific date, number of payments or total dollar amount.

- You cannot schedule a recurring transfer to start Today. The Send On date will need to be a future date for this type of transfer. If you need to make a transfer today, make a One Time Transfer first. Then, setup a recurring transfer for a future date.

- Slide to submit your transfer.

Statements

Navigate to the eStatements page.

- Choose which accounts you’d like to receive a paper statement for and which you’d like to receive an eStatement for by toggling the radio buttons on the page.

- Click next to review your choices.

- Click enroll to submit.

If you’re not already enrolled to receive eStatements you must enroll first.

From the Dashboard page:

- Scroll to the bottom of the page and find the Other Resources section.

- Click Statements from the list to be taken to the Statements page.

- Identify the account you’d like to see the statement for and click View Statement next to that account.

- This will reveal a popup with a link to View PDF. Click the link to download your statement.

From the Account Details page:

- Click the three dots icon at the top of the page to reveal the Accounts menu.

- Click Statements from the menu to be taken to the Statements Page.

- Identify the account you’d like to see the statement for and click View Statement next to that account.

- This will reveal a popup with a link to View PDF. Click the link to download your statement.

Until the time you’ve enrolled, you will receive a paper statement. Our eStatement service only begins tracking your statement online after you’ve set up eStatements for each account.

Once you enroll in eStatements, your paper statements will be discontinued. You may elect and continue to receive a paper statement; however, depending on your account type, a fee may be assessed for each paper statement you receive. There are no charges for eStatements.

Notifications

Navigate to the Notifications Setting page.

- Review and agree to the Terms & Conditions.

- Click Manage Recipients to review and add new email and phone numbers available to receive notifications.

- Click Manage Notifications to review existing notifications settings and add new notifications.

Alerts that deliver personal information, enrollments, secure messages, etc. are triggered immediately by the activity.

Alerts that deliver information based on transactions are triggered when the transaction is processed in your account. Let’s say your account balance is $110 and you setup a notification to alert you when your account drops below $100. If you make a $20 transaction, bringing your balance to $90, you will receive an alert when the transaction is processed in your account.

Alert delivery may be subject to delays, including service outages and connection issues.

Security & Fraud Protection

Please see our policy on security and fraud prevention here.

To conveniently submit debit card transaction disputes, use the Online Forms feature.

We have several measures in place to ensure that your account and data are protected. They include:

.Bank domain and industry level encryption

CPB uses the .BANK domain, which is only available to verified members of the banking community. To use the .BANK domain, CPB is required to uphold robust security technologies and practices resulting in a more secure location for your online services.

Encryption from your device and/or browser to our online and mobile banking platforms ensures the confidentiality of your transactions and sensitive. We use 256-bit encryption to guarantee that your data is protected with the highest level of security.

24x7 fraud monitoring

Automated systems and our dedicated Fraud team help to keep your accounts safe. Our fraud monitoring and detection systems are supported with specialized monitoring services focused on monetary transactions specific to External Transfers, Bill Pay, and Zelle.

Multiple layers of intrusion prevention and detection

Your accounts are kept safe behind multiple layers of protection including intrusion detection and prevention systems, web applications firewalls, and malware prevention systems that prevent cyberattacks against our mobile and online banking platforms.

In the event of an attack, our incident response teams are swiftly alerted to take action.

Risk-based, multi-factor and device authentication

Artificial intelligence systems help our Fraud team protect your CPB accounts from unauthorized access. Out-of-band authentication and other security controls are activated when performing certain account activities as well as when suspicious activity or fraudulent threats are suspected.

If unusual activity is detected on your account, a CPB team member will contact you by phone or email.

Regularly performed security testing

Regular testing is performed to ensure our security systems remain effective. Testing also detects and reduces vulnerabilities and threats to our online and mobile banking platforms, as well as our supporting technology systems.

Threat intelligence monitoring

We collaborate with threat intelligence organizations and practice preventing new cyber threats, which prepares our response teams and stakeholders in the event a perceived threat becomes reality.

Dedicated cybersecurity and fraud professionals

A team of security and fraud professionals are dedicated to the protection of your sensitive information and financial transactions.

Automated account lockout

When you reach a certain threshold of failed logins with the wrong username, password or out-of-band authentication, your access to digital banking will be locked.

To unlock your access, contact our Customer Service Center at 808-544-0500 or toll-free at 1-800-342-8422.

There are several tools you can use to help you keep your account protected.

- Add a layer of security by setting up customizable real-time notifications and alerts.

- Take advantage of biometrics authentication by enabling login using fingerprint or facial recognition.

- Use the Money Manager feature, a convenient dashboard that empowers you to monitor your financial transactions for suspicious activity across all your accounts, including with other banks, credit unions, credit cards and retirement funds.

- Use the debit card management tool to oversee all debit cards that are associated with your CPB accounts, such as a family member’s card. This tool offers security features such as reporting cards lost or stolen, temporarily disabling cards, enabling alerts, restricting merchants and transaction types, setting region limits and transaction amount limits as well as blocking transactions over a certain amount.

- Access online forms to conveniently submit travel notifications or dispute credit card transactions.

- Log off when banking tasks are completed.

- Close your browser or mobile app after use.

- Avoid using untrustworthy laptops, tablets or mobile phones to access your account. If you must use a device that is not your own, never save your username and password on that device.

- Ensure the contact information associated with your account (telephone numbers, address and email) remains current.

- Monitor your account transactions on a regular basis.

- To improve your digital security, avoid using the same username and password for multiple applications. And, if you have been using the same username and password for a long time you should change it.

ACH Payments

For instructions on how to create and edit participants, download our ACH participant guide here.

For instructions on how to create or initiate an ACH template, download our guide here.

Yes, you can create a one- time ACH transaction. For instructions on how to create and process a one-time ACH, download our guide here.

You can navigate to the ACH activity link via the Business Apps menu to view pending and scheduled batches as well your ACH activity. For instructions on understanding your ACH activity, download our guide here.