CPB WE by Rising Tide - applications now open

Central Pacific Bank (CPB) is thrilled to announce applications are open for the WE by Rising Tide program, a free initiative empowering women entrepreneurs to thrive. This highly successful 10-week program, led by CPB and the aio Foundation and in partnership with Patsy T. Mink Center for Business and Leadership, equips women with the tools and confidence to propel their businesses forward.

Founded by heroes

The Central Pacific Bank Story, since 1954

Our legacy can be traced back nearly 70 years ago when Central Pacific Bank was founded by Japanese American veterans who served in the legendary 442nd Regimental Combat Team, 100th Infantry Battalion, and Military Intelligence Service. They refused to accept the social inequities immigrant families in Hawaii faced after World War II.

Caring for our ‘Aina and People

CPB believes that a commitment to sound corporate governance practices, including social, environmental, and economic responsibility, is important to our success as a company. As such, we are committed to integrating governance, social and environmental considerations into our business practices and operations. Our priority is to mitigate risk and improve performance, while optimizing the positive impact on our business, customers, employees, community, and environment.

Offering expert insights on a variety of topics such as home affordability, small business growth, international economic trends, and digital banking.

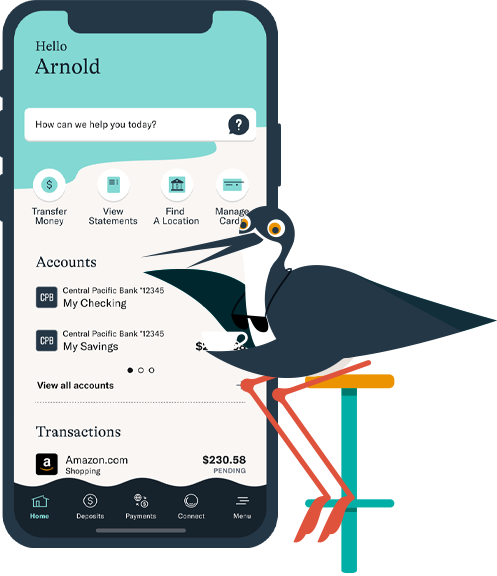

Discover our Top-Rated Apps

Experience the new look and feel of the upgraded mobile banking application from Central Pacific Bank. We've made it easier to access the features that will help manage your banking on the go.